Is Analyst Buzz Over ET’s Valuation Shaping the Long-Term Investment Story for Energy Transfer?

- In recent weeks, Energy Transfer has faced heightened analyst and investor attention following reports of a significant pullback and mounting discussions of the company’s relative undervaluation across several financial metrics.

- Despite the short-term uncertainty, analysts continue to highlight Energy Transfer’s strong fundamentals and earnings potential, which has helped sustain interest in the company’s long-term prospects.

- We’ll explore how recent commentary spotlighting Energy Transfer’s valuation and earnings outlook may influence the company’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Energy Transfer Investment Narrative Recap

To be a shareholder in Energy Transfer, one needs confidence in the company’s ability to capitalize on large-scale energy infrastructure growth and ongoing demand for natural gas and NGL exports. While the recent pullback in the stock price and valuation debates have raised the profile of near-term earnings as a catalyst, this news does not materially alter the most important short-term driver: the company’s execution on key growth projects. The primary risk remains weaker-than-expected volume growth tied to market or operational headwinds.

Among recent company announcements, the expansion of the Transwestern Pipeline stands out. This multi-billion-dollar project is expected to boost natural gas supply to Arizona and New Mexico, aligning with Energy Transfer’s strategy to secure greater volumes and stable, fee-based revenues even as market sentiment fluctuates around short-term stock price movements.

Yet, it is important to recognize that even as these expansions continue, a sudden downturn in Bakken and Permian volumes could quickly test…

Read the full narrative on Energy Transfer (it’s free!)

Energy Transfer’s narrative projects $99.8 billion revenue and $6.7 billion earnings by 2028. This requires 7.4% yearly revenue growth and a $2.2 billion earnings increase from the current $4.5 billion.

Uncover how Energy Transfer’s forecasts yield a $22.55 fair value, a 35% upside to its current price.

Exploring Other Perspectives

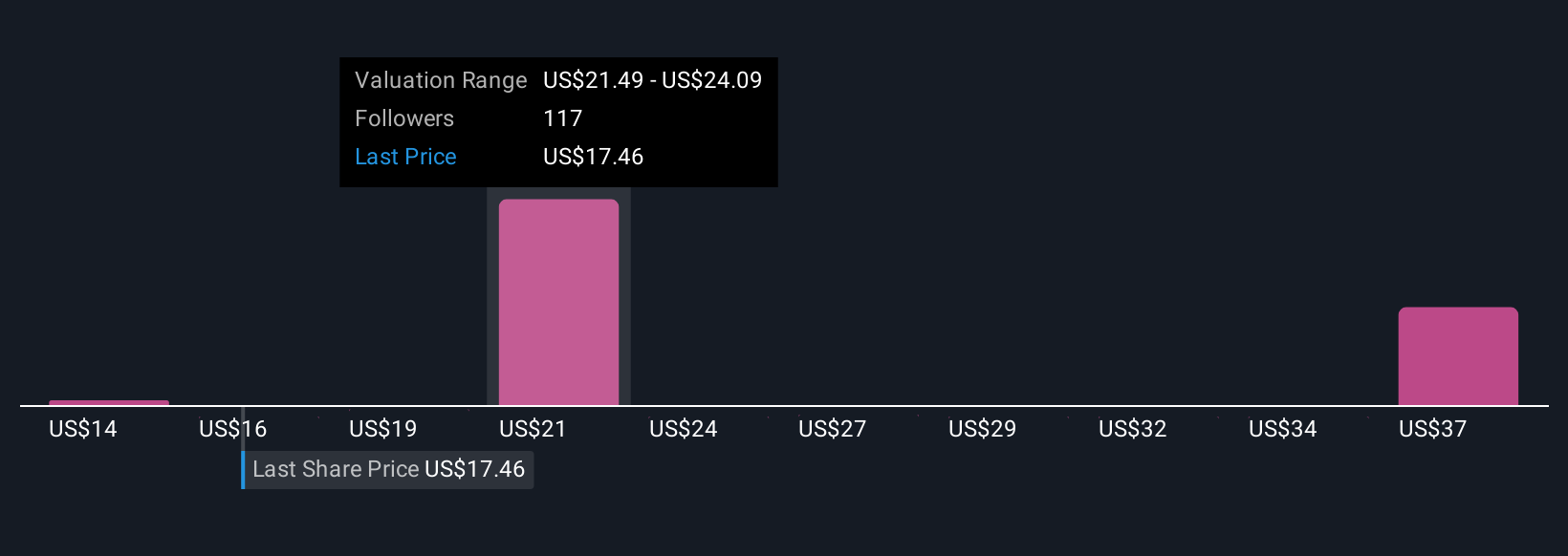

Fair value estimates from 22 Simply Wall St Community members span US$13.75 to US$41.37 per share, revealing wide-ranging outlooks. Even with such variety, many are mindful that ongoing execution challenges on multi-billion-dollar projects could drive significant variability in future performance.

Explore 22 other fair value estimates on Energy Transfer – why the stock might be worth 18% less than the current price!

Build Your Own Energy Transfer Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link

:max_bytes(150000):strip_icc()/investing20-5bfc2b8f46e0fb00517be081.jpg)